You can always discuss what the right definition for inflation is (see: To inflate or not to inflate). I personally like the Austrian definition, that is advocated by Mike ‘Mish’ Shedlock of globaleconomicanalysis.blogspot.com: inflation is measured by looking at the total supply of money and credit in an economy.

And although the amount of money expanded substantially during the last three years, the amount of available credit contracted heavily during this year and especially during the period 2008-2009.

This Austrian definition is a very clean definition that explains why markets are contracting, in spite of the huge amounts of money that are available in the markets, due to Quantitative Easing and other programmes to spur the international economies.

For the Dutch situation, it explains:

· the dropping hourly rates for consultancy hours and temporary jobs;

· the dropping stock rates (?)

· the dropping prices on the housing market;

· the dropping prices for oil

A second, often officially used method is the method of the so-called basket-of-goods. The prices of a certain basket filled with standardized commodities, goods, services and other costs of living are compared from month to month / year to year.

Although you can discuss about how representative this basket is for groups of people with different interests and different standards of living, it gives an impression of the general price level in a country. Therefore this method is very usable in daily life, in contrary to measuring the total supply of money and credit in an economy. This is unfortunately (virtually) impossible to measure.

Today, October 6, the latest inflation data on the Dutch economy were presented by the Dutch Central Bureau of Statistics (http://www.cbs.nl/). These data are based on the aforementioned basket-of-goods method.

Here are the pertinent snips of the CBS-report:

Inflation rises to 2.7%

· Inflation increases, due to more expensive clothing and gasoline

· Telephone and internet service suppress inflation

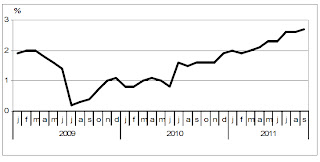

The inflation rose to 2.7% in September, 2011. In August , the inflation was still 2.6. This is showed by CBS-data.

The inflation increased particularly as a consequence of the price development of clothing. In September 2011 the price of clothing increased by 3.2% YoY. The price of gasoline had also an increasing effect on inflation. A liter of Euro95 costed in average €1.67 at the gas station in September 2011, versus €1.50 in September 2010 (+11.6%).

The price development of telephone and internet services suppressed inflation, because last year September’s large price increase for these services is now off the data.

|

Inflation data measured by www.cbs.nl

Click to enlarge

|

That the measured inflation for the basket-of-goods increased to 2.7% (3.0% according to HICP) means that:

- Purchasing power of people diminishes, when the wages do not also increase by at least 2.27% in 2011 (an average calculated on the inflation marks until September 2011)

- Above all the people that earn an equal income in 2011 as in 2010 or even less, see their purchasing power evaporate. It depends on their spending pattern how much pain they feel, but fact is that people in this situation will feel pain from this.

- Especially when this inflation is aggravated by government cutbacks on widely used social services, like unemployment benefits, healthcare and childcare facilities.

- Your current account with its zero interest compensation, costs you in 2011 in average 2.27%. This is quite a fee for storing your money at the bank. And this is even except the administration fees for handling your account.

- Your savings account at the average large bank with its 2.6% of interest, in reality yields you only 0.33% interest per year: an insulting amount that now luckily is increasing steadily (see again the ‘To inflate or not to inflate’-link)

The fact that all other investment options are either too expensive (gold), too unreliable (high yield-sovereign bonds) or too unpredictable (low yield-sovereign bonds, corporate bonds, commodities and stocks), means that saving is currently almost the investment-of-last-resort.

Therefore you have to ‘fight for your right’ for good interest rates at your own bank. And if the bank doesn’t want to offer you a decent interest rate, I would advise you to go shopping for better interest rates: in The Netherlands that is at least 2.85%, but rather more.

The only checks you have to do before storing your money at the bank is:

- investigating what the government-warranted savings amount is in your country (In The Netherlands €100,000)

- checking if your savings amount is not exceeding the warranty-limit

- checking whether the bank of your choice is covered by the state warranty for savings amounts of your own country (or any other EU country)

In this way you can fight the inflation as much as possible, without gambling with your money.

No comments:

Post a Comment