A couple of weeks ago, I wrote my analysis concerning the IPO

of insurance company NN Group in The Netherlands.

One of the main questions that I had with respect to the stock was of course:

what will be the introduction price?!

I initially calculated with a total yield somewhere between €8 and €12 billion euro, which I considered to be too high, based on historical profits in 2012 and 2011; as 2013 even yielded a profit close to nought, this would blur the financial picture too much. When the Price / Earnings

ratio would indeed be too high, this could be a less interesting stock, in

spite of the promise by parent company ING Group 'that the NN Group insurance company would become a dividend stock'.

Yesterday, the uncertainty ended: the bandwidth

for the introduction price will become €18.50 - €22 per share, for a total

of 70 million deployable shares. This is 25% of the total number of shares to be deployed before the end of 2016.

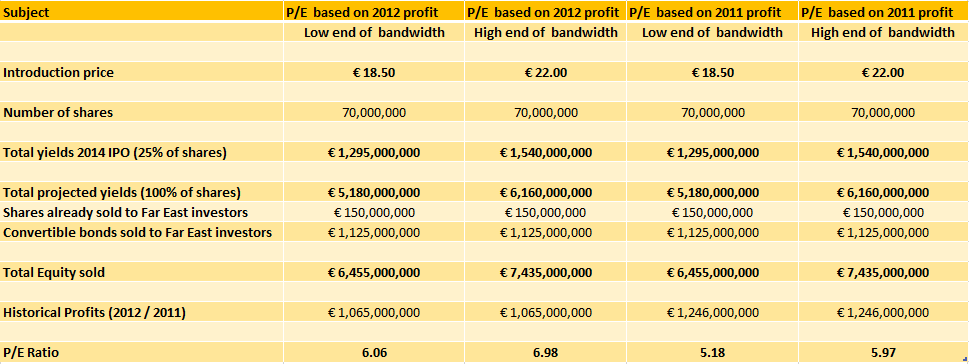

This brings us to the following calculation of the P/E

ratio:

|

| P/E Ratios calculated using the designated introduction bandwidth and the historical profits of 2012 and 2011 Data courtesy of: www.nngroup.nl and www.fd.nl Click to enlarge |

The good thing is that the P/E ratios in the aforementioned

table, calculated with the designated €18.50 - €22 bandwidth, are clearly lower

than the range of 1:7 – 1:11, that I considered in my first article on NN Group (see

the first link).

Nevertheless, the shares still have a stiff price,

especially when you consider that:

- The company hardly

made any profit in 2013: only €18 million (see part I of this article series);

- The company only paid dividend once during the past three years,

which is not exactly good advertising for a designated dividend stock;

- The Dutch market – the domestic market of NN Group – is yet in a state of coma, when it comes to life insurances, as an important NN Group product;

- The Usurious Profits Policies affair (i.e. Woekerpolisaffaire) is still hanging above

NN Group’s head as Damocles’ sword and, at the moment, the future does not look

too bright for a ‘soft landing’ of this affair in the coming years;

- The

Advocate-General of the European Court of Justice advised on June 12, 2014,

“that the insurance company should have given full disclosure to buyers of its investment

policies, with respect to the cost structure of these policies”, based on the

European Insurance Ruling of 1992;

- This advise unfortunately increases the chances for a negative verdict from the European Court of Justice;

My conclusion is that NN Group seemingly chose for a

moderate sales price per share, which – in my humble opinion – considerably improves

the chances for nice dividend yields per share and for stable, perhaps even slightly

rising rates at the stock exchanges.

Positive is that there is a considerable chance for growth of NN Group on its home markets, like the Eastern European countries, Greece and Turkey .

However, there is still a substantial amount of risk in this

share; especially due to the anaemic life insurance market in domestic market

The Netherlands and the coming verdict of the European Court of Justice, which – when negative – could lead to a new influx of legal cases against NN Group.

That is the reason that I only advise to invest in NN

Group with caution.

Disclaimer: This

analysis is solely written with the purpose of information supply.

I don’t have any

financial or business strings attached to this company. As I am not an investor

myself, I don’t have any financial purposes with this advise, except for

supplying people with free and interesting information.

People are free to

follow up my advises or not. However, I can’t accept any responsibility for the

investment decisions that people make, based upon the advises mentioned in this

article.

No comments:

Post a Comment