During the last two years, I wrote few articles about the Dutch housing market.

The main reason was that there were many other

interesting topics to write about, while the Dutch housing market itself showed

little change and improvement during the last few years. Besides that, I felt

that I had said almost everything that needed to be said about it and I did not want to repeat myself.

Still, last Friday the Dutch Central Bureau of

Statistics (www.cbs.nl) came with the ‘good’ news (for sellers; not for buyers), that the Dutch

housing market in May, 2014 had improved in comparison with last year: not only the

sales had increased dramatically year-on-year, but even the housing prices were

(slightly) up.

Here are the pertinent snips of the CBS press release:

Prices

of owner-occupied houses, excluding new constructions were on average 1.4%

higher in May 2014 than in May 2013. In April 2014, the first year-on-year

price increase (0.1%) in 5 years was recorded.

Prices

of owner-occupied houses have been stable for more than a year now and are at

approximately the same level as in early 2003. They were 20% below

the record level registered in August 2008.

Sales

of owner-occupied houses continue to rise. In the first five months of this

year, 51,709 homes were sold, an increase by more than 36% relative to the same

period last year.

For people, whose mortgage is under water (i.e. the remaining

loan sum is higher than the market value of the collateral house), this is particularly

good news.

Now these people have an outlook to earn back some of

the (paper) losses on the value of their home. And on top of that, the improved

sales numbers mean that it will be slightly easier to sell their house within a

reasonable period of time.

Still, I advice you to not raise the flag yet!

On 1 July 2014, the ceiling amount for the Dutch ‘National

Mortgage Guarantee’ or NHG – a guarantee from a semi-governmental organization,

which protects houseowners against residual debt, in case of an involuntary

housing sale – will

be substantially reduced to €265,000 from the current €290,000:

As

a consequence of this reduction [of the NHG guarantee ceiling amount], many future buyers

could miss a discount on the interest rate to the tune of 0.7% for a mortgage loan

with a ten year fixed interest rate. This will increase the monthly payments for a €250,000

dwelling with €100 to €150 per month.

In my humble opinion, the increased housing sales and

slightly higher housing prices during the first five months of 2014, do not come

as a surprise.

I think that many people grab the opportunity to make a ‘last

minute’ buy of a house with an NHG guarantee at the current €290,000 ceiling

amount: especially the people whose designated house lies within the price

range of €265,000 - €290,000.

Consequently,

the true benchmarks for 2014 will be the housing sales numbers and housing

prices in July and the remainder of this year. Afterwards we will have a better

overview, whether the Dutch housing market indeed improved in 2014, or that the

improvements have been (again) the results of government intervention in the

Dutch housing market.

Besides that, one should remember that the price level

of Dutch dwellings has returned to 2003 levels (see the red and bold text), while the

current average interest rate on mortgages is 1.3 % (!) lower than in 2003.

This shows what an enormous beating the Dutch housing market bore during the

last six years.

To spice up this article, I have created a few charts of

the Dutch housing market, based on data from the Central Bureau of Statistics

and Dutch national bank De Nederlandsche Bank (i.e. average mortgage interest rates).

These charts show the price index and sales numbers,

during the last 20-odd years and also – on the following chart – the influence of the interest

rate on the average housing price and sales numbers:

| |

|

As I

mentioned earlier at this site, the Dutch housing crisis strongly accelerated

after the start of the credit crisis in 2008, but it is not caused by the

credit crisis, even though this is a popular myth.

In January 2006, the average interest rate on mortgages

started to rise strongly again, after being in a record-low trough for about a year. This had the

following consequence: after hitting record sales in January 2006, the average housing

sales number started a period of steady decline, which lasted until 2013: a

mindboggling seven years.

On top of that, after the mortgage interest rate hit peak level in September 2008, the housing prices also started to decline. This price

drop has lasted until April 2014, in spite of the record low interest levels

since September 2013.

|

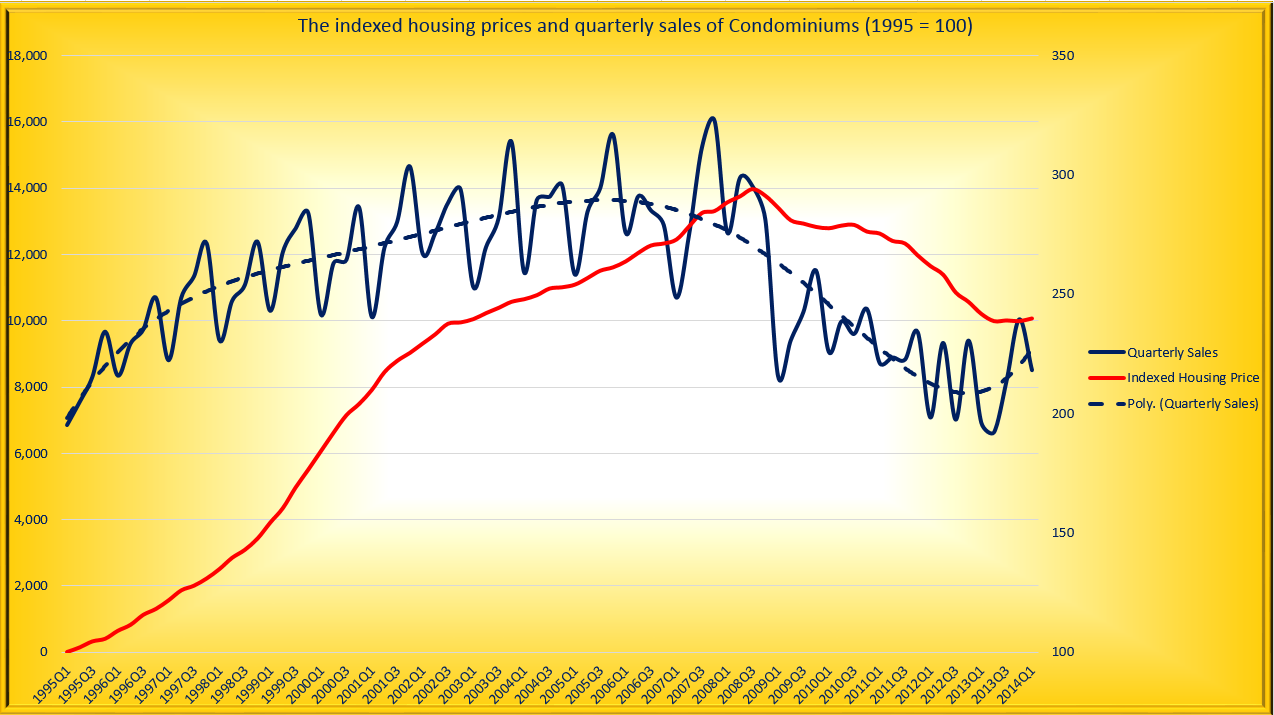

| The indexed housing prices and quarterly sales of Condominiums (1995 = 100) Chart by: Ernst's Economy for You Data courtesy of: www.cbs.nl Click to enlarge |

This particular chart shows that the price of condominiums has risen sharply since 1995: with 194%. However, the decline of prices, since the highest price level was reached, has only been 22.6%. This brings the proportion between the pre-crisis price increase and the subsequent post-crisis price drop to a record 8.6.

The reason that the price decline for condominiums has

remained fairly low is – in my humble opinion – that most condos are relatively

cheap ‘social’ houses.

Unsubsidized rental houses in the same category became much more expensive since 2008: see for instance the chart in this article, which shows housing rent raises versus the official inflation rate in The Netherlands since 1989.

This means in reality that a cheap owner-occupied condo or house-in-a-row is often much less expensive than a rented house in the same category: even at the current, still high housing prices. This is the reason that you see a similar phenomena at the houses in a row:

Unsubsidized rental houses in the same category became much more expensive since 2008: see for instance the chart in this article, which shows housing rent raises versus the official inflation rate in The Netherlands since 1989.

This means in reality that a cheap owner-occupied condo or house-in-a-row is often much less expensive than a rented house in the same category: even at the current, still high housing prices. This is the reason that you see a similar phenomena at the houses in a row:

|

| The indexed housing prices and quarterly sales of Houses-in-a-row (1995 = 100) Chart by: Ernst's Economy for You Data courtesy of: www.cbs.nl Click to enlarge |

Nevertheless, the price drop since the highest price level has only been 20.2%. This brings the proportion between pre-crisis price increase and post-crisis price decline to 8.4 for houses-in-a-row, which is also very high in comparison with more expensive types of dwellings.

|

| The indexed housing prices and quarterly sales of Residential Houses (1995 = 100) Chart by: Ernst's Economy for You Data courtesy of: www.cbs.nl Click to enlarge |

In the years before the crisis, the average price of residential houses increased by a staggering 239%, but after the crisis started, the average price plummeted by 32.1%.

This brought the proportion between pre-crisis price increase and post-crisis price decrease to 7.5, which is quite low.

This means that both the price increase and price decline have been particularly dramatic for residential houses.

|

| The indexed housing prices and quarterly sales of Semi-detached Houses (1995 = 100) Chart by: Ernst's Economy for You Data courtesy of: www.cbs.nl Click to enlarge |

With 189%, the price increase of semi-detached houses was also quite high before the crisis, but so has the price decrease since the crisis started: 27.1%.

The result of these changes is the lowest proportion between the pre-crisis price increase and the post-crisis decline: 7.0.

Just like with residential houses, the price of semi-detached dwellings has suffered dearly from the crisis.

|

| The indexed housing prices and quarterly sales of Corner Houses (1995 = 100) Chart by: Ernst's Economy for You Data courtesy of: www.cbs.nl Click to enlarge |

This makes sense, when you compare the fixed expenses per month of such a house with the price of a comparable house on the free (as in ‘unsubsidized’) rental market.

Summarizing, one can state that the Dutch housing

market is indeed improving, with increasing housing sales numbers for all kinds

of dwellings and even average sales prices, which are cautiously rising.

However, it is much too early to call it a day for the

crisis on the Dutch housing market.

Only after the NHG ceiling amount has been lowered on July 1st and the sales numbers and housing prices remain rising in the following months, we ‘might hear the fat lady sing’. Besides that, even then it might take years and years before the consequences of this ferocious Dutch housing crisis have been polished away.

Only after the NHG ceiling amount has been lowered on July 1st and the sales numbers and housing prices remain rising in the following months, we ‘might hear the fat lady sing’. Besides that, even then it might take years and years before the consequences of this ferocious Dutch housing crisis have been polished away.

The worst consequence for me of this improving Dutch housing

market is, however, that the Dutch government might see the aforementioned positive developments as an encouragement to postpone further attempts:

- to abolish the Mortgage

Interest Deductability (MID) policy, which

keeps housing prices at an artificially high level, due to the strong reduction

of the net interest rate, which homeowners have to pay;

- to make it slightly easier for Dutch citizens to get rid of their excess mortgage debt. Nowadays, it is almost impossible to get rid of excess mortgage debt or residual debt after an involuntary housing sale;

- Even banks that blatantly overcredited people in the years before the crisis, hardly suffer from the consequences of their reckless actions.

This would mean that the utterly disturbing MID policy

(for the Dutch housing prices) remains in place and that many Dutch citizens

will remain slaves of their excess mortgage debt in years and years to come.

What a shame!

What a shame!

No comments:

Post a Comment