Last Friday, 13 June, the Dutch Central Bureau for

Statistics had very positive news with respect to the Dutch retail industry.

After years and years of misery and decline, this industry seems finally on the

way up.

Here are the pertinent snips of their press release:

Turnover

non-food sector growing for fourth consecutive month

The

Central Bureau of Statistics announced today that retail turnover was 3.4% up

in April 2014 from the same month last year. For Dutch retailers, this is the

largest turnover growth since November 2010.

Though

cautiously, the recovery recorded in the first quarter appears to continue in

the second quarter. Consumers’ willingness to buy improved. They spent more on

food, drinks and tobacco products than last year. Turnover generated by the

non-food sector grew marginally.

For

the fourth month in a row, the non-food sector realised turnover growth

relative to the same month in 2013. Such a long period of consistent turnover

growth is more than six years ago, although growth over the past months was

marginal. Nearly all branches within the non-food sector performed better in

April.

Consumer

electronics shops achieved good results, but home furnishing shops

underperformed. Home furnishing shops have seen their turnover fall over the

past thirty months. Apparently, the recent recovery on the housing market does

not have a positive effect on the home furnishing branch.

When I read this CBS good news show a few days ago, I was a little bit

puzzled.

It just didn’t seem to match with the cautiousness of the Dutch

population, which I observed; unemployment is still high and there are yet very few signals of

quick improvement of the employment situation or rising wages, as a matter of fact.

To the contrary: there are voices that the healthcare

industry might lose between 10,000 and 100,000 jobs in the coming years. This might have a devastating effect on - especially - feminine unemployment.

This was for me the reason to collect the source data

from the magnificent CBS Statline source database and find things out for myself.

General

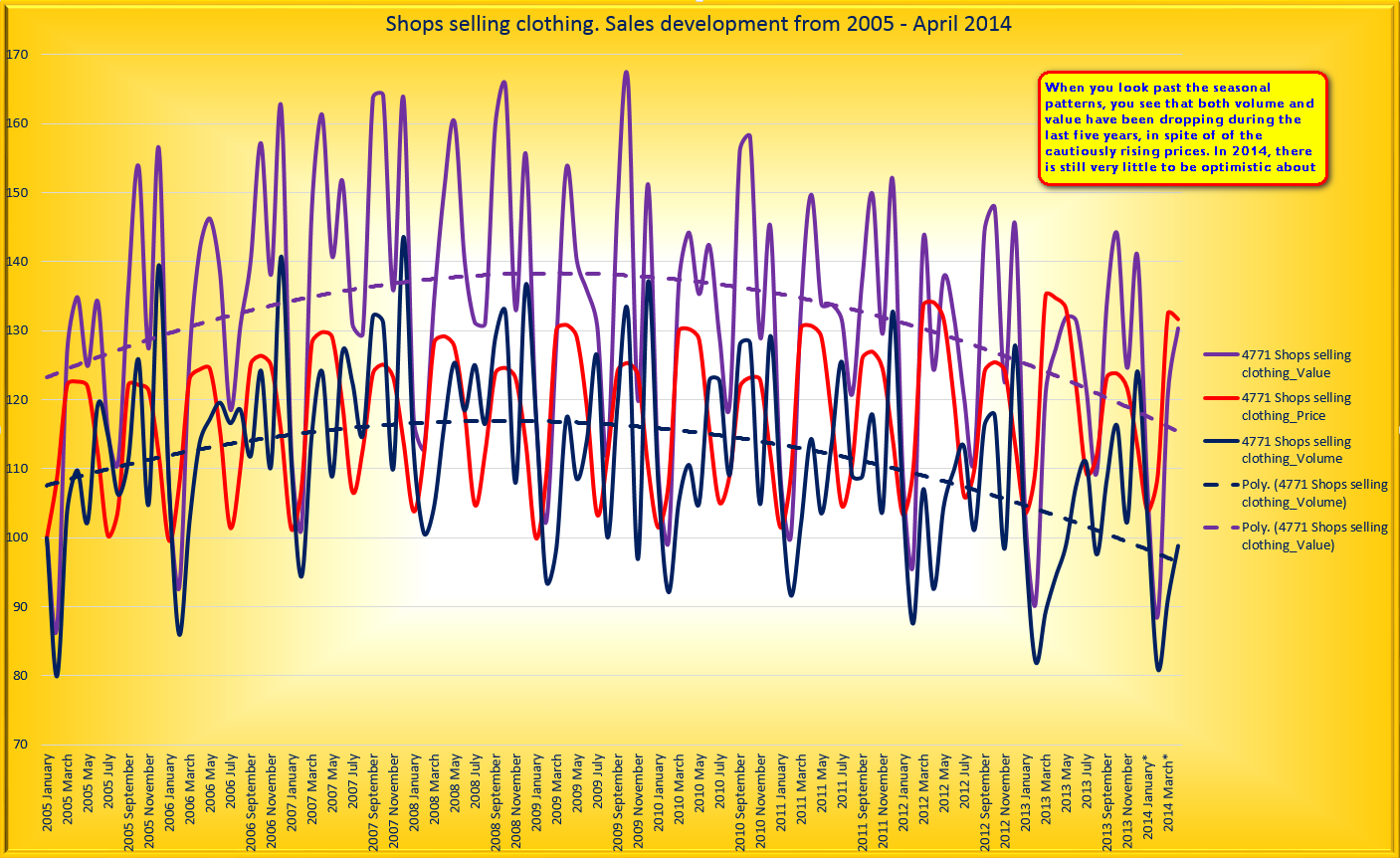

conclusion, if there is any sign of improvement in the first place, the sign is mostly in the value and not in the volume of retail sales. This increase in value is mainly caused by rising prices and seldomly by rising sales.

|

| Sales development from 2005 - 2014 Supermarkets and similar stores Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2005 - 2014 Specialized shops selling food Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2005 - 2014 Shops selling Consumer Electronics Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2005 - 2014 Shops selling other household equipment Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2005 - 2014 Shops selling recreational goods Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2005 - 2014 Shops selling clothing Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2005 - 2014 Shops selling footwear and leather goods Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2009 - 2014 Shops selling medical goods and drugstores Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

|

| Sales development from 2010 - 2014 Retail sales via Internet Charts by: Ernst's Economy for You Data courtesy: statline.cbs.nl Click to enlarge |

Exception to this very phenomena is consumer electronics

sales. In this retail area, the enduring ‘kamikaze‘ price wars of the last decade have depleted the sales value.

This happened in such a manner, that even the slightly increased and quite high sales volumes (from a historical point of view) in this “Olympic-Games-and-Worldcup-year”

can’t diminish these negative price effects.

After looking at these charts, there is only room for

one conclusion: the retail industry has - in most cases - a long, long way to go to

only reach 2005 sales levels. And then we don't even talk about 2008, just before the economic crisis set in.

The only real exceptions to this are the categories:

- Retail sales via Internet, which has been soaring since 2010 (to these eyes this is a sign of a yet immature market);

- The supermarkets - in my opinion, their success came at the expense of the specialized food shops;

- Shops selling consumer electronics (in volume only, not in value (!))

Therefore the whole propaganda, that the crisis

might be over within the retail industry in 2014, seems to be built on very thin ice.

And I truly wonder why CBS participated in this

propaganda, to be frank, as their source data really seem to point elsewhere…

No comments:

Post a Comment