“This

economic crisis that started in 2008 is like an Amazing Discoveries infomercial from the late eighties;

it seems to last forever and there is always more on offer than you have

bargained for!”

Ernst

Labruyère - 2015

Although very few people dare to call this vast

economic crisis for what it is, it is becoming perfectly clear that we are in

the midst of a heavy depression.

A depression that is here to stay for years to come; perhaps even unless something really dramatic happens, like a war or a world-altering new

invention. And when we see how the moods are deteriorating

globally at this very moment, a devastating war seems a realistic possibility, unfortunately.

“But”, you

could argue,”it seems that the Dutch

economy is currently going through a revival

with rising housing prices, increased producer and consumer confidence,

seemingly ubiquitous economic growth and a general rise in imports and exports.

And the European Union as a whole is doing fine at this moment, isn’t it?!”

Yes, you are more or less right. Yet, it took seven years of

waiting, a vessel-load of additional money and liquidity in the financial

markets and near-zero interest rates from the ECB to achieve this "success".

And on October 15th, the Dutch Central Bureau of

Statistics stated that the drop in unemployment and the rise in the number of

jobs, which was a trademark of early 2015, came

grindingly to a standstill in July and did not resume anymore until this date:

Early

this year, the number of unemployed started to fall, but in the past three

months the decline has come to a standstill. Statistics Netherlands (CBS)

reports that 607 thousand people or 6.8 percent in the labour force were

unemployed in September, i.e. the same amount as in July and August.

[...]

The

number of people in paid work is about the same as in June. Until June, the

working population had grown. The number of people working at least 12 hours a

week increased, but the number of people working less than 12 hours a week

decreased at the same rate.

The good news from the last snippet is that a part of

the Dutch people has seemingly exchanged its limited-hour job for a job with more

working hours. That is good news indeed for people with a small job, who

desperately want to work longer hours. The bad news is, however, that the real growth

has seemingly disappeared from the economy, when it comes to the rise in

employment in The Netherlands.

And when the outlook for rising employment is not exactly

great at this moment, but the Dutch people again run the risk of turning into ‘debt

slaves’, due to the attractive, extremely low interest rates, steadily rising housing prices

and (consequentely) increasing mortgage principals, this is also bad news, disguised

as good news: nice for the people with an excess mortgage and an underwater

house, but bad for the rest of the country, which has to borrow more money

again in order to pay for their new house.

And now the inflation seems again heading for the

gutter. Not only in The Netherlands, but all over Europe.

Besides that: enly the slightest

hint of higher interest rates or other dampening measures is enough to cause

sheer panic at the financial markets. A few weeks ago, about one week of trading was all it

took to blast the whole annual profits at the stock exchanges for 2015 to smithereens in The

Netherlands and many other countries (see the charts in the bottom of this article).

That the financial markets since then regained some of their

profits for 2015, does not change anything at all about this worrisome fact. There

is only stability on the markets, when bad news stays away; that is not real

stability, isn’t it?

And how about the mood of the Dutch citizens?! Well, read

this!

Last Wednesday, the Dutch Central Bureau of Statistics

presented two tell-tale charts,

accompanied by the statement that “the

Dutch have more confidence in the European Union than in their own Second

Chamber of Parliament”.

To grasp the real impact of this message, one has to

remember that the Dutch confidence in the European Union is not exactly high:

less than 40%!

|

| Percentage of Dutch people with confidence in national institutions Source: www.cbs.nl Click to enlarge |

|

| Percentage of Dutch people with confidence in Second Chamber of Parliament Source: www.cbs.nl Click to enlarge |

Again, these are depression-like figures and they have

everything to do with the fact that people lost even the smallest bit of basic

trust in their politicians and often just don´t feel represented by them

anymore. And even though this has something to do with the

credibility of the current generation of politicians (of course ), I personally consider

this rather a ‘mood-thing'.

That is for the simple reason, that I fundamentally

doubt whether the current generation of politicians is really worse than the

previous generations. Probably not, which means that the reason for the people's distrust lies in the people themselves. People are simply depressed by the enduring

economic hardship.

On top of that, one should not forget that the mounting

tensions regarding the Syrian and Eritrean refugees within Europe - currently the hottest topic in the news - and

especially The Netherlands are partially the result of a mood crisis. Of course

there are real refugee crises within Italy, Greece, Hungary and Germany, and

its logical that this leads to tensions within the population.

However, in The Netherlands there is already an ongoing refugee crisis

without(!) an increased influx of refugees:

|

| The percentual difference between the influx of refugees between the first 7 months of 2014 and 2015 Data courtesy of flipvandyke.nl and Eurostat Click to enlarge |

Like this chart with Eurostat data shows, there have

been real refugee crises in Hungary, Germany and perhaps Austria, while other

countries also experienced strongly elevated inflows of refugees (although

eventually still relatively small numbers remain for 2015; henceforth, I avoid the

word crisis).

However, The Netherlands (orange row in the chart) had

actually a decrease(!) in the number of refugees during the first seven months

of 2015. So what is the political and societal fuzz about, in reality?! It is a lot about

moods, overhere!

That is why I don’t think that the Dutch economy will

start to structurally grow again, until people feel better in general or have

something to collectively strive for and roll up their sleeves for. That will also be true for the rest of Europe, I think. And whether

people feel better, due to a growing economy or an economy will grow due to

people feeling better, is of course an endless chicken-and-egg discussion, although I tend to believe the latter.

And look at things from this perspective: when the whole Middle-East

and North-Africa seem at war with each other, the tensions between Europe and Russia, as well

as within the former Soviet Union, are mounting by the day, the American economy is faltering and the

emerging markets are rather akin to imploding markets; what are the odds of the

European Union and especially export-tiger The Netherlands of getting through

this period unharmed?!

Besides that, is there another way to describe the

Chinese economy than that it has been hit by Thor’s hammer?

The following snippets of the following very interesting article, about

the depression-like outlook for the world economy, are from The

Guardian:

The

heart of the economic disorder is a world financial system that has gone rogue.

Global banks now make profits to a extraordinary degree from doing business

with each other. As a result, banking’s power to create money out of nothing

has been taken to a whole new level. That banks create credit is nothing new;

the system depends on the truth that not all depositors will want their money

back simultaneously. So there is a tendency for some of the cash banks lend in

one month to be redeposited by borrowers the following month: a part of this

cash can be re-lent, again, in a third month – on top of existing lending

capacity. Each lending cycle creates more credit, which is why lending has

always been carefully regulated by national central banks to ensure loans will,

in general, be repaid and sufficient capital reserves are held. .

The

emergence of a global banking system means central banks are much less able to

monitor and control what is going on. And because few countries now limit

capital flows, in part because they want access to potential credit, cash

generated out of nothing can be lent in countries where the economic prospects

look superficially good. This provokes floods of credit, rather like the

movements of refugees.

The

false boom that follows seems to justify the lending. Property prices rise.

Companies and households grow overconfident about their prospects and borrow

freely. Economies surge well above their trend growth rates and all seems well

until something – a collapse in property or commodity prices – unravels the

whole process. The money floods out as quickly as it flooded in, leaving bust

banks and governments desperately picking up the pieces.

Well, that article leaves little room for discussion, it seems.

And as a piece-the-resistance, I want to show some

charts and tables, which show that the real, durable growth might yet be a thing of

the (quite distant) future:

AEX Amsterdam Index, for 2015 Year to Date

Data courtesy of Bloomberg

Click to enlarge

|

CAC40 Paris Index, for 2015 Year to Date

Data courtesy of Bloomberg

Click to enlarge

|

|

DAX Frankfurt Index, for 2015 Year to Date

Data courtesy of Bloomberg

Click to enlarge

|

|

FTSE 100 London Index, for 2015 Year to Date

Data courtesy of Bloomberg

Click to enlarge

|

|

Hang Seng Hongkong Index, for 2015 Year to Date

Data courtesy of Bloomberg

Click to enlarge

|

|

Standard & Poor's 500 New York Index, for 2015 Year to Date

Data courtesy of Bloomberg

Click to enlarge

|

|

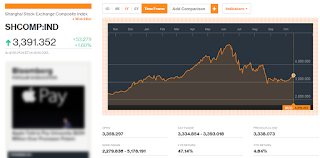

Shanghai Composite Index, for 2015 Year to Date

Data courtesy of Bloomberg

Click to enlarge

|

|

Price development agricultural

commodities in 2015

Data courtesy of Bloomberg (?)

Click to enlarge

|

|

Price development precious metals in 2015

Data courtesy of Bloomberg (?)

Click to enlarge

|

|

Price development fuels in 2015

Data courtesy of Bloomberg (?)

Click to enlarge

|

|

Price development steel in 2015

Data courtesy of Bloomberg (?)

Click to enlarge

|

|

Price development crude oil in 2015

Data courtesy of Bloomberg (?)

Click to enlarge

|

What these charts showed, is that the ongoing third leg of the

depression is an “all-inclusive” leg with virtually no exceptions... in any

market and for any commodity. This third leg of the depression might point out to be a very serious new crisis.

Nevertheless, and to end on an optimistical note, there should be no reason for structural

pessimism, according to one of the smartest people that I know, Kevin Depew of

(formerly) Minyanville in a personal tweet:

This

is the 3rd stage [of the crisis]. The Emerging Markets breakdown. [This is] Prelude

to 1st stage of global growth. Best I can do. Long term.

Kevin Depew was the first to call the current crisis a

depression... in 2008. He has been so right about that, in hindsight.

So let us patiently wait, with Kevin's reluctant optimism

as a guideline and not give up on the economy... and the world itself.

In the West, we've reached peak oil, peak debt, peak"youth", peak health etc etc. These factors have boosted our economy tremendously since 1945.

ReplyDeleteHowever, now all this is in decline. Due to climate change, demographic change, indebtedness, health costs, social security costs, corruption, lack of trust and irresponsible political leadership.

Like we discussed on Twitter, sharing economic growth is easy for people. Sharing economic decay creates massive social tensions.

I can recommend the book "The End of Growth" by Richard Heinberg. It shows that this depression will last a few decades, due to demographic reasons and many other, unless something extraordinary will happen, like you said.

http://richardheinberg.com/bookshelf/the-end-of-growth-book

Thanks for this wonderful comment. I will try to have a look at this book (as time is my enemy currently with my busy daily job)

ReplyDelete