Today is a typical day for the SMS from Ernst: lots of

little news and little big news.

Freelance professionals forced to visit food banks

Today I read an alarming message in the Dutch

newspaper Telegraaf (www.telegraaf.nl) on the freelance professionals or ZZP-workers

(i.e. Independents without personnel) as they are called in The Netherlands.

This

year for the first time freelance professionals and little shop-owners

registered at the food banks in The Netherlands. ‘These people also have a

tough time’, according to spokesman Harrie Timmerman of Foodbanks The

Netherlands. ‘In the current crisis we are worried about what next year will

bring’.

In

2011 the food banks saw again growth in the total number of people applying for

a free food package. Exact data is not yet available. ‘Especially the last

months the numbers are soaring. More and more people are registering. And now

also freelance professionals and little shopkeepers and entrepreneurs in the

small and medium enterprises. In recent years these people started as freelance

professionals, but now these people seem extra vulnerable when the situation deteriorates.

Freelancers are often not insured sufficiently, so they must look for help.

About two months ago I already wrote on the awkward

position of the freelance professionals in the article: The

freelance professional might be the biggest victim of the next recession, when

it comes. I quote here some snips from this article:

People

in the building and construction industry, the free professions, the medical

world and in the ICT and Consultancy industry that one day, under pressure,

decided to make a start-up on their own.

Often

lured by the high hourly rates they see on the horizon, and optimistic, very

motivated and sometimes unaware of the implications, they took a step that

might cost them dearly in the not-too-distant future.

Now

the economic situation for the 3rd and 4th Quarter still looks grim and the

near future might not be much better, these freelance professionals run a

substantial risk of running out of work.

Many

freelancers decide eventually to pull the plug out of their company and look

again for a steady job. But in bad economic times, these jobs might be very

hard to find, leaving the freelancers in poverty, as a hidden unemployment

statistic.

It seems that the ZZP-workers are now indeed getting

into poverty as the hidden unemployment statistic that I already warned for.

Expect many more alarming messages on this group in the months to come.

The Commercial Real Estate (CRE) disaster

I didn’t write for some time on the situation in the

CRE-business in The Netherlands, but it still remains disastrous. How disastrous became clear

today, when an auction of commercial real estate was a complete failure, in

spite of discounts up to 40% on the original sales prices.

The business newspaper Het Financieele Dagblad (www.fd.nl) writes on this story:

The

situation on the Dutch Commercial Real Estate-market is even more worrisome

than presumed earlier. This became clear through the failed auction of the

CRE-portfolio of real estate enterprise Uni-Invest.

Even

at a discount of 40% the financier of Uni-Invest, German bank Commerzbank,

failed to get rid of 200 buildings. The utter failure of this intended multimillion

euro transaction makes painfully clear how much more has to be written off on

weak CRE in The Netherlands. In april of this year the Dutch national bank ‘De

Nederlandsche Bank’ (DNB) wrote already that the write-down of ‘bad’ objects had

hardly started yet. According to the supervisor, the reason that CRE-firms were

sitting on the fence is that it is very problematic to set a marked-to-market

value for CRE almost without any transactions.

Uni-Invest

ran the gauntlet and doing such the company was followed very closely by the

whole CRE-industry. CEO Pieter Roozenboom of the destitute company states that ‘he

still trusts in a positive ending’.

Arjen

van Bussel, partner of the London Consultancy firm Bishopsfield Capital

partners, is not surprised by the recent developments. ‘It’s a known fact that

a large wave of debt roll-overs is coming and at this very moment, now that a

crucial phase is coming for the large number of real estate loans that needs to

be rolled-over, we are confronted with the facts. It is now even harder than

previously to acquire a loan. Banks are only preprared to lend money for CRE on

prime sites like the Amsterdam Zuidas.

Commercial Real Estate is now at the summit of the proverbial

pigs cycle with an excess amount of CRE at uninteresting locations that

virtually can’t be sold; not even at 40% discount. In the recent past every community needed desperately

to have its own industrial and commercial zone and every city hall was bewitched

by the attraction of earning top dollar on ground sold for CRE projects.

Small commuter cities like Zoetermeer, Hoofddorp,

Sassenheim, Almere and many others thought they could be on top of the world by excessively building

real estate and luring companies with high subsidies to move to these cities. After

a while, the large international companies moved back to the A-locations, close

to Schiphol and other airports. And now the world is in a deep recession (or

did I say depression), the small and mid-size companies move to smaller/cheaper

locations or even default, leaving their vacant office buildings to rest as

scars on the surface of the city.

The difference with the real pigs cycle is that pigs

have a short life expectancy and can easily be bred again, thus making the cycles

relatively short.

The CRE cycle is very long as CRE is very hard to get rid of.

The excess CRE will be vacant for years and might even never be inhabited, as future

buildings will be more energy efficient and it is very expensive to refurbish

existing CRE. Unless these buildings are demolished in a few years, they will

stand there as sad reminders of this building frenzy that came over The

Netherlands during the last 20 years.

Mood among business service providers still

optimistic, but declining

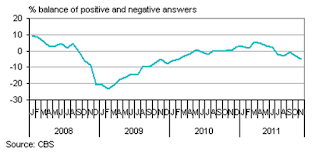

The Dutch Central Bureau of Statistics (www.cbs.nl) reported

on the declining, but still optimistic mood among business services providers:

In

November, business services providers anticipating turnover growth in the next

three months outnumbered those anticipating a downturn. At +18, the index was

lower than in October (+29).

Providers

of business services were more pessimistic about future employment in their

sector than in the preceding month. A net 14 percent expect to have to cut back

on staff in the coming three months.

Business

services companies were equally pessimistic about the economic climate in

November as in October. The number of companies in this branch expecting prices

to increase in the next three months outnumbered those expecting a decrease in

prices.

|

| Expected turnover business services www.cbs.nl |

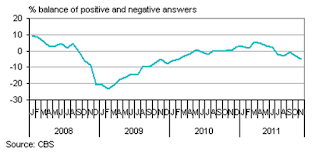

Mood among manufacturers get worse.

Was the business services industry a positive outlier,

this seems not true for the manufacturing industry, according to the CBS.

Mood

among manufacturers continues to worsen

The

mood among Dutch manufacturers deteriorated further in November. Sentiments

about future output, in particular were more negative. The producer confidence

indicator dropped from –3.2 in October to – 4.8 in November. The manufacturing

industry has not been this depressed for almost two years.

Producer

confidence consists of three component indicators: the expected output over the

next three months, manufacturers’ opinions on their order positions and

opinions on their stocks of finished products.

The

drop in producer confidence can be attributed entirely to manufacturers’ much

more pessimistic view on future output, which deteriorated considerably.

Manufacturers were somewhat more optimistic about their order positions.

Opinions on stocks of finished products hardly changed.

For

the fifth month in a row, manufacturers expecting employment in their branch to

increase in the next three months were outnumbered by those expecting staff to

be reduced. In this period, the group expecting employment to decline has

steadily grown.

Manufacturers

indicated that the value of orders received has fallen slightly in recent

months. At 100.5, the order position index (orders expressed in terms of months

of work) was somewhat up on October.

|

| Producer confidence in manufacturing industry www.cbs.nl |

If you would look only at the aforementioned order position index,

you would wonder if the pessimism is justified. But everybody knows what is

going on in the Euro-zone and the rest of the world. And everybody knows this

will have its impact on the exports of goods and thus eventually on the manufacturing

industry.

Even if the debt problems in the Euro-zone will be finally solved on Friday, December 9 (which is very, very implausible), this will not come in time to

prevent this recession from happening. I am convinced that there will be a

surge in pessimism in the manufacturing industry in the coming months.

No comments:

Post a Comment