There isn’t a market in The Netherlands, where government officials, insiders and pundits so often try to sell ‘hope’ as an investment strategy, as the Dutch Residential Real Estate market (RRE).

Statements like 'now is the perfect time to buy a house', 'those nasty pessimists spoil the mood of buyers' or 'when all talking about abolishing the Mortgage Interest Deduction stops, the housing market will recover', try to persuade potential buyers into buying a (much too expensive) house.

But there aren’t many markets where hope is such a bad investment strategy as on the same RRE-market.

The latest residential real estate data of the Central Bureau for Statistics (http://www.cbs.nl/) was again little cause for fun & games. The data was not good, as regular readers of my blog already would have guessed. Here are the pertinent snips of the CBS monthly report:

Prices of existing owner-occupied houses were on average 2.8% lower in August 2011 than in August 2010. According to the price index of existing residential property – a joint publication by Statistics Netherlands

All types of dwellings were cheaper in August 2011 than one year previously. Prices of detached houses dropped most (4.5%), prices of terraced houses the least (2.1%).

Prices fell in almost all provinces. With more than 5%, residential property prices declined most in Limburg and Gelderland . Zeeland was the only province to show a price increase ( 1.7%).

Prices of existing residential property units declined by 0.7% relative to July 2011. In nine out of twelve provinces prices dropped; the most in Limburg and South Holland (more than 2%). With 2.6%, Utrecht

Around 10,000 existing owner-occupied houses changed hands in August, almost 4% fewer than in August 2010. In the first eight months of 2011, over 78,000 houses were sold, a decline by nearly 5% compared to the same period last year.

Readers that don’t know the situation on the Dutch housing market, could think that these declines in housing prices and housing sales are (only) caused by the credit crisis. They could think that the housing prices will increase again, when the credit crisis is over and the financial stability returned to the markets.

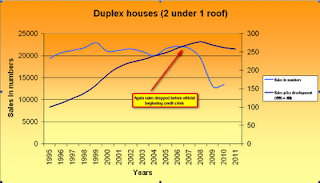

Here are five charts with the price development vs. the sold number of houses for the five most popular housing types in The Netherlands, measured since 1995. In these charts, I will show you that the sales decline already set in well before the start of the credit crisis in The Netherlands. And I'll show you that before 2006, the value of all house types almost tripled. As in a bubble...

All chart data is courtesy of the Dutch Central Bureau for Statistics (http://www.cbs.nl/). For obvious reasons, the sales data for 2011 is missing, but the general sales decline for housing in The Netherlands is 5%, until September. This number will probably increase in the coming months:

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

|

| Click to enlarge |

Although it differs from one housing type to another, the general decline in sales in The Netherlands already started in 2006.

In 2006, the credit crisis in The Netherlands was still some two-and-a-half years away:

· Therefore the credit crisis was not the cause for the decline in housing sales and...

· The bank rules for lending and mortgages were at that time still: ‘the sky is the limit’.

· There was also no government legislation on its way yet.

· Although there was a little rise in the interest rate in 2006, which might have triggered some mood change under house-owners, since then the average interest returned to about the 2005 level;

When these four circumstances are likely not the cause for the drop in sales (although some might have acted as a catalyst), there must have been a different reason.

In my opinion, this reason was a ‘peak oil-ish’ situation in the Dutch housing market: housing prices had to start dropping, because they couldn’t go up any further. The declining sales numbers were the 'messenger' in this process.

The price difference between houses in The Netherlands vs Belgium and Germany 2006, in less than 12 years.

The price difference was even bigger when you looked at the amount of terrain you received with your house in The Netherlands vs Belgium and Germany

This spread in housing prices between these countries was caused by the ample availability of extremely cheap money for house-owners in The Netherlands: the interest rates on mortgages since 1995, have been well below the median interest of 7% of the 50 years before.

On top of that, the low price of mortgage money was strongly reinforced by the Mortgage Interest Deduction (MID), that brought the bank interest rates of 3.5% - 5.5%, effectively back to 1.75% - 3.25% (for much more on this topic, please fill in MID or Mortgage Interest Deduction at my search engine).

On top of that, the low price of mortgage money was strongly reinforced by the Mortgage Interest Deduction (MID), that brought the bank interest rates of 3.5% - 5.5%, effectively back to 1.75% - 3.25% (for much more on this topic, please fill in MID or Mortgage Interest Deduction at my search engine).

And banks were more than happy to fill your wallet to the brim for house purchases. This situation was roughly comparable to the situation in the US

And suddenly in 2006, the peak housing price was reached. Housing sales declined strongly and the housing prices lagged for a year, before also starting to drop (slowly). This process is enduring up to this day and it won't stop within five years, I guess.

The reason that the housing prices didn’t drop more ferociously, can be found in my article “Dutch RRE market remains locked up badly”.

The main reason remains that it is almost impossible for someone to get rid of residual mortgage debt, when this person sells his/her house for a lower price than the mortgage amount (i.e. the seller had been under water).

This is THE reason that people don’t lower their prices and that the housing market remains locked up badly. People can’t afford to sell their house and get stuck with residual debt; so they keep their house and pray for better times.

This is THE reason that people don’t lower their prices and that the housing market remains locked up badly. People can’t afford to sell their house and get stuck with residual debt; so they keep their house and pray for better times.

The government could have made an important step by abolishing the MID (saves €9bln in subsidies per year) and by offering an intermediate arrangement (subsidy) for people to pay back excess mortgage, but it didn’t. Instead, it decided to kick the can down the road.

And until the day that the MID is abolished, or banks find a way to free people from excess mortgage, the housing market will remain firmly locked. And every new overview of the CBS proves my point over-and-over again.

We can approach this problem financially, and you are doing a good job at that. But we can also approach it from its actual consequences on well-being. What does it *mean* to young people that they are forced to buy a house at a much too high price, three times as high as only 15 years ago?

ReplyDeleteFirst, it means that it takes a long time for people to find a steady home and settle. Young people in the 1980s and halfway the 1990s could find a steady job within a few years after graduation, and create a situation in which they could focus on settling down and, for instance, raise a family. Now this has become much harder. Not only because steady jobs or tenure is less available, and moneylenders are getting stricter on lending conditions. But also because wages earned by young people up to 35 often are insufficient to buy a house. And affordable houses for rent are more scarce than ever. In urban areas the monthly rent typically takes up two-thirds of a starting salary.

Thus, finding and getting yourself a house that matches the settling-down phase in life has become harder and young people will have to shift that desire until they are 35 or older.

A workaround for this has been to include two full salaries in the mortgage. This means that both partners commit to maintaining two full-time or at least 1,5 full-time jobs. As a consequence, we have moved within only a few years' time from a 'breadwinner' system to a 'two working parents' system, with no financial benefit for the two working parents! The second income is dissipated by the extreme mortgage, combined with the high (and growing) costs of daycare for their children.

The net effect is that in order to maintain an average standard of living - i.e. to live in a plain house and raise two or three kids - young people are forced two create an extra income, close to full-time, and to have their children raised by a day-care centre. With the all too well-known consequence that children and their parents only have 'quality time' between 18 and 20 o'clock, when they are both tired, and fight over dinner before going to bed.

Besides, the parents are forced to take an excessive financial risk, owning a house at triple or at least double the price of what it is worth in financially bad times. And they have exhausted a large part of their 'buffer' possibilities to create a bigger income in case of financial disaster.

Show me the progress in all of that.

And then to know that the previous generation has only created this disastrous house 'market' strategy in order to optimize their own profit - whatever the cost for the next generation.

Tell us why we should be thankful for that.

And then to know that this problem you are addressing has been widely foreseen and discussed and neglected. Already in 1998 the Dutch 'Socialist Party' (of all parties) proposed to cut off MID at a house price of 125.000 euro, then the median house price plus twenty percent.

ReplyDeleteSuch measure would leave over 80% of all mortgages unaffected, and would only touch the mortgages of people with the most expensive houses, who could afford to find finance for their house's value over 125.000 without the government's 'assistance'.

But what is more: such measure would take away the urge for a continuous increase of house prices. Above 125.000, there would be no extra tax gain. Yet it is this promise of an unlimited tax gain relating to higher mortgages that has rocketed house prices sky-high.

The Dutch ruling party, VVD, uses in its rhetoric that people should not be made 'addicted to subsidies', should be responsible 'for their own choices' and should not use the state as a 'automated Fortune Machine'. But this is exactly what VVD has been up to regarding their policies on the house market: making people addicted on MID and on 'surplus value' of their house, and shift responsibility for finance on the government, who is to bring them Fortune by means of handing out tax euro's.

Thank you, Hannes for your very valuable commentary. I agree totally on your conclusions concerning the socionomic results of this desastrous policy.

ReplyDeleteOne addition: the MID have been present for years, but it was the deadly combination of MID with extreme low interest, that put this machine really in motion and skyrocketed the prices.

One more tragic perspective. The present Dutch right-wing government says it needs to save 19 billion on expenses in order to lower the state deficit. This is doing damage to the social, cultural and educational infrastructure, which is defended by the argument that 'we must all contribute'.

ReplyDeleteYet even in this moment of crisis, MIT beneficiaries do *not* contribute. The MID is left as it is, and the net expenses for MID will raise in 2012 from 10 to 11 billion.

In sum, the larger part of what the Dutch are told that they 'need' to save on income, medical care, education, social services and culture are billions that are needlessly handed out to home owners with sky-rocketing mortgages, sky-rocketing surplus values, who insist on having the government pay their mortgage for them.

Of course, bricks are bricks and houses remain the same, whether they cost 100.000, 200.000 or 300.000 euro. Yet the MID system helps to get millions of tax money in the pockets of money-lenders and building companies, facilitated by national governments who don't care and by local governments whose interest is to sell building lots for the highest price to the citizends whose interests they are to serve.

What we have is a housing 'market' that combines the worst of the capitalist system (high and hardly affordable prices) with the worst of the communist system (state control, government monopoly, hardly any alternatives, bad price-quality ratio, wasted tax-money).

Happy to have recently found your blog and finding it quite interesting. I spent 20 years in the real estate industry in the US and abroad and have never seen a more dysfunctional or dangerous system. With the highest mortgage debt to gdp ratio in the developing world, the housing market has the potential to totally destroy the seemingly solid Dutch economy.

ReplyDeleteMy husband and I are in the exact situation you've described - in a house with a mortgage that exceeds market value by almost 20%. To make matters worse, I have to leave the country for medical reasons and he is of course coming with me and there's no way we can sell our house in time or at the price we'd need to pay off the mortgage. We can't even get into a debt-recovery plan because we're leaving the country and we're not Dutch citizens so we're never planning to come back. We're trying to find a way to settle this before we have to leave but there doesn't seem to be any alternative to just abandoning our property and the mortgage completely. If you have any insight as to what the consequences of that are - or any suggestions as to how we might find someone who can help us resolve this legally - it would be greatly appreciated. I can't even find a lawyer who's willing to talk to us. Such a strange system here...

Anyway, Hannes is absolutely right - it's the absolute worst of capitalist and communist systems combined. I'm happy to be leaving as everything points to an even more serious crisis for the Dutch people coming in the very near future.

Thank you, for the compliment, Alexis. Please stay tuned and spread the word to your friends in the US and everywhere.

ReplyDeleteI hope that your medical situation is not very bad and I wish you good luck with it.

Concerning your house, you are unfortunately in a very awkward situation. You just can't go out of your house and leave the keys to the bank, like in the US. The residual debt will stay with you.

On the other hand I don't know what will happen with you and your husband, as you are foreigners that won't reside in Holland anymore. The bank might find it impossible to claim the lost money, so they will perhaps write it off.

One thing that you could do IMO is getting in touch with a bona fide firm that mediates between (temporary) tenants and landlords/houseowners. In this way you could rent your house for a few years and receive the yields in order to pay down your mortgage. When the housing prices are rising again, you could sell your house.

But please, take a mediation firm of good reputation with rock-solid contracts, as the tenant protection laws are gruesome in The Netherlands and you don´t want to get stuck with tenants that won´t leave your house as you can sell it.

Further I wish you the best of luck with getting rid of this question. And the Dutch housing market? Something's got to give, sometime

We should hope for the best in our current real estate market these days. As the 2011 year ends, we should be more optimistic on the coming 2012 and that we should face the challenge of this market for use to be able to survive such downfall. Real Estate school

ReplyDeleteHi Ernst, and everyone else. The information you all have provided is very beneficial. I do not know much about housing markets. I have been living in Rotterdam for three years now. Renting a small apartment. The apartment is perfect for me and has a low rent per month, but i plan to live here for a extended period of time and will be interested in purchasing a home. Time is on my side, but I hope you all can answer a few questions for me so I can have a better understanding of the market and what will happen in the future.

ReplyDelete1. Do you expect the MID system to be completely phased out? And when?

2. Do you expect a rapid drop in prices before stabilizing?

3. which is a safer purchase, residential house or apartments?

4. when do you expect a good time to buy is?

I hope my questions are not too direct and you will be willing to help. I will continue to follow your blog as i have found it to be the most sensible and understandable information available. Thanks!

1. I expect the MID indeed to be phased out, but that will be a matter of 5-10 years, I suspect

ReplyDelete2. Housing prices drop slowly because of the high mortgages of people. Nobody wants to be stuck with residual debt. Therefore price destruction will take at least 5 years.

3. Both are equally safe purchases. The price increase since 1995 has been in the whole housing market, so the price drop will also be.

4. I would stay in your renting apartment for 2-3 more years. Stay put and be patient; the house of your dreams might be 15% cheaper in 2015.

Cheers,

Ernst

Quick! Thanks a lot Ernst. Cheers, Zach

ReplyDelete