People have the habit to rationalize their own behavior, in a way to understand it themselves:

- When people have a fight with their loved ones, they tell themselves they did it for a clear reason and the other person was wrong.

- When people are ranting in traffic, they tell themselves that the people in the other cars were lousy drivers and deserved to be yelled at.

- When people like or don’t like someone, they try to objectify their instinctive choices by afterwards looking for objective reasons.

- When people trade in stocks, they tell themselves their decisions to buy or sell stocks were based on objective observations.

Economists even have the habit to rationalize the way of behaving of masses of people world wide:

- Companies are looking for profit maximalisation

- People try to reach a certain result with the least possible effort

- People all try to look for prosperity, love, happiness and security.

And if this all were true, there would be no serial killers, no suicide-bombers, no terrorists and no wars, unless for territory and primary/ secondary necessities. And there would also be no bear markets, no economic downturns, no housing bubbles and exchange rates would be quite stable throughout the years. But unfortunately, the self-rationalizations and economic dogmas are often false… And there are serial killers, wars, bear markets and housing bubbles.

And the bad thing is: the fact that people are not (always) rational beings, makes it a big problem for investors and traders to predict their behavior. For the sake of clarity, I will put down my defintions of the concepts investors and traders:

Investor | a person investing his own or borrowed money for a medium to long period in order to gain profits from long term exchange rate rises and dividend payments |

Traders | a person investing his own or borrowed money for a very short (1 day) to short period (1 week) in order to gain profits from short term exchange rate rises |

But between all irrational behavior of individual people and markets, there are certain patterns of habits that can be recognized in masses of people and that can be used to the advantage of (especially) the traders.

However, long-term behavior of people is so much harder to predict than short-term behavior that very little analysts and “investment guru’s” actually made any profits over the last 15 years in their off-index strategies for stockpicking.

Here I show you seven factors that have (strong) influence on the build-up of stock prices. Use them to your advantage while trading or investing in stocks, but remember: it is always your own choice whether you want to buy or sell a stock, or not. Not mine. I am not responsible for flawed decisions on your behalf.

1. The fundamentals (the rational data)

Knowing that human behavior is often irrational doesn’t mean that you should forget the fundamentals.

- Value of (cashlike) assets on the balance of a company

- Realized or foreseeable profits and losses

- Volatility of an industry and its position in the economic wave.

- Foreseeable one-time or recurring costs

- Being ante or ex-dividend for a stock

- Market benchmarks from the line of business

These are all important factors to decide the value of a stock. Is a stock underprized, than in general you do have reasons to buy it. Is it overprized, than you can better sell it. But these are not the only factors that decide the value of a stock.

2. The table of expectation

The exchange rates of a stock at times of financial data (quarterly data, annual data) are influenced by what you could call “the table of expectation”:

Annual / quarterly results are | What does the stock price do? |

Good and better than expected by analysts | Goes up (strongly) |

Good, but worse than expected by analysts | Goes down |

Exactly as expected by analysts | Remains stable / goes down slightly |

Bad, but better than expected by analysts | Goes up (slightly) |

Bad and worse than expected by analysts | Gets hammered |

Todd Harrison of Minyanville (www.minyanville.com) always says: in trading, the reaction to the news is more important than the news itself. He is spot-on there.

3. The herd instinct

People in large groups are often acting like herds: they switch-off their own thinking capabilities and follow the leader of the flock (trendsetting analysts, influencial people/companies in society and important media that choose a certain direction). You can see this behavior especially during every trend and hype. You should remember here, that a negative reaction on herd-like behavior can be devastating for a stock, as suddenly the whole herd goes in a different reaction.

Example: when during the internet bubble a company with auspicious prospects did an IPO, the sky was the limit for the exchange rates of this stock. Even if the company never made one cent of profit yet, the billions of dollars were flying around. That’s why we called it a bubble. Look for currently hyped companies to : Facebook, Twitter, Groupon and you know what I’m talking about. This is herd-like behavior.

The leader of the flock (Goldman Sachs in this case) tells the people that Facebook is worth €45 bln. Everybody is believing it, without thinking how much money must be earned by Facebook itself to return the €45 bln that will be paid on the stocks. When the herd suddenly discovers that the company in question will never earn so much money, the stock get hammered to well below the intrinsical value of the stock, because the herd suddenly thinks that the stock is worth nothing. Then it is time to hit the stock, unless (of course) there is no intrinsical value at all and the stock was just a castle-in-the-air.

Also concerning the indexes there are clear signs of herdlike behavior of traders and investors. During short-term and long-term periods index rates are following fixed and repetitive patterns. Kevin Depew of Minyanville has written a bunch on the DeMark-indicators.These indicators in general predict the behavior of buyers / sellers in times of rising and falling index rates, by signalling a number of repeated actions that lead to a buy setup or a sell setup. I must admit that I don’t understand this technique, but I respect its predictive capabilities on short-term trades.

4. The socionomic mood

Kevin Depew and Todd Harrison of Minyanville have written many articles about it: moods shape markets and not the other way around. When the social mood is right and everybody is optimistic, the exchange rates in general will go up. When the social mood is pessimistic, exchange rates in general will remain stable or even go down. The hard part is predicting what will trigger a turn over of this social mood, because the most money is made at turnover points.

5. Computerized stock trading

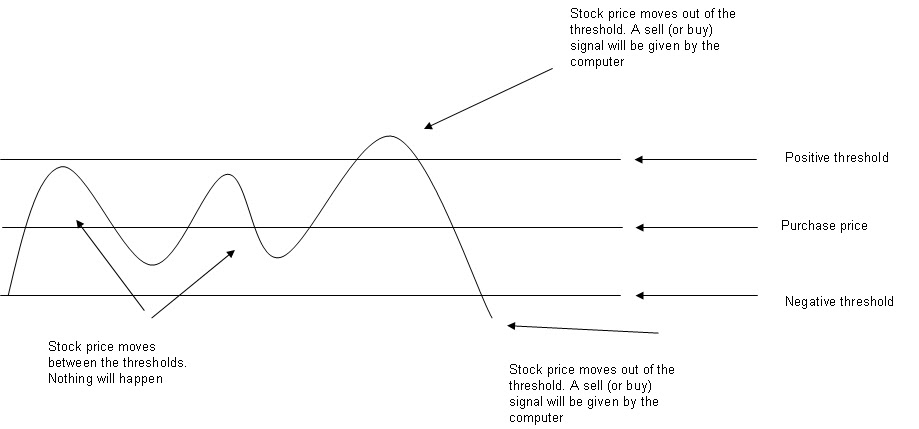

|

| How thresholds work |

This working with thresholds can lead to a situation of accelerated buying or selling of stocks during situations of extreme volatility, when thresholds of all traders trigger buying or selling actions at the same time.

If you are in the middle of such a phenomena, you better run like hell, as huge amounts of money can be lost.

6. The orchestrated rate

Everybody wants to be honest, but some people want it a little less than others. And some people have better information than others: frontrunners and people with inside knowledge. If you see strange volatility in stocks that are normally very stable in price, you can bet that someone with more knowledge than you is rigging the price. Then you know there will be important news shortly. Whether you get in or get out of the stock depends on your risk appetite, but watch out: some official might find your behavior suspect.

7. The invisible hand

This is a phenomena that Minyanville has written a lot about:

Governments worldwide have the opinion that markets help to shape moods (see bullet 4) and that for stock prices “the only way is up”, in order to bring optimism back in the economy: optimistic people are consuming people, while pessimistic people sit on their savings. Therefore governments want to help the stock market in gaining momentum. Normally governments will do this quite openly by setting all rules and standards at the position: “investor and shareholder friendly”.

But sometimes governments do this more under the cloak of darkness by straightly influencing the prices of certain stocks änd indexes without telling anybody. This phenomena is called the “invisible hand”. This could be one of the reasons for the current “bear market” / secular bull rally (depending on your personal mood) that is already lasting for a long time (since 2009).

Existence of this invisible hand has always been denied, until the former Finance Minister of George W.Bush, Hank Paulson admitted there was such an invisible hand.

Knowing the existence of this invisible hand won’t help you investing in general. But it’s good to be aware of the forces around you.

No comments:

Post a Comment