Five years ago, in May, 2011, I had a written discussion

with Conor Sen (@conorsen on Twitter), a very savvy trader / investor from Atlanta (USA) and –

at the time – a prominent member of the Minyanville investment blogging community,

of which I was a member too in those days.

Conor Sen declared – in an article on Minyanville – why LinkedIn would be worth $25 billion in five years (i.e. 2016).

Although I understood his vision in that article, I did not fully buy it. As a response to his article, I declared why LinkedIn would NOT be worth $25 billion in 2016; also on Minyanville and on this very blogsite.

At the time, the IPO of LinkedIn was an exciting event, taking place amidst the (partially successful) IPO’s of other social networks, like Facebook, Groupon and Twitter.

Conon

Sen was an investor, who especially saw the future value and yet unfulfilled promises of these

social networks. He was especially enthusiastic about the future possibilities

of LinkedIn (snippets from Connor's article):

So anyway, I like the

data economy as an investment theme, I like LinkedIn's place in it (nobody

other than Google (GOOG) or Facebook is better positioned), and I like

LinkedIn's team, starting with Hoffman. What about the stock?

In 2010 it took in

$243 million in revenues. In the first quarter of 2011 it took in $94 million,

up 110% from $44.7 million a year ago. That makes trailing 12-month revenues

$292 million. What sort of multiple does that deserve? For comparison, recent

high-flyer Internet stocks like OpenTable (OPEN) SINA Corp (SINA), and Baidu

(BIDU) trade at 18.9x, 17.0x, and 25.4x, respectively. Facebook 2010 revenues

were roughly $2 billion, and with some estimating a current value of $70

billion, that'd put Facebook around 35x sales. LinkedIn going public at $4.5

billion, or 15.4x trailing 12-month revenues, seems entirely reasonable by

comparison.

I expect this strong

growth for LinkedIn to continue for years. Hoffman believes there's room for

more than one online profile, with room for at least a social profile

(Facebook) and a professional profile (LinkedIn). I agree, and actually believe

LinkedIn's barriers to entry are higher than Facebook's. When it comes down to

it, how valuable is that marginal high school friend posting Mafia Wars updates

vs a marginal professional contact on LinkedIn who could one day lead to

another job or professional opportunity? Hoffman envisions a world where

LinkedIn, for example, would monitor analytics about trending skills and types

of companies in a particular city, allowing users to see what skills are in

demand and find resources to attain those skills to become more valuable in the

marketplace.

At the time I – as a 'renowned' non-investor – was especially

anxious about the enormous amount of ‘future growth potential’ that was priced

in in stock like LinkedIn, Groupon and Facebook. To these eyes it would be nearly impossible to meet this growth potential in reality, so I reckoned that the IPO-prices were 'over the top'.

Instead of taking f.i. 15 times the annual profit,

which was a usual price goal for most stocks, these tech-stocks yielded about

20-25 times the annual revenues at the time of their IPO, which seemed

to be outrageous to these eyes. That was the reason that I responded to Conor in my article:

In my forecast, I take

LinkedIn’s statement about future declining profitability into account, by

letting it rise initially from 2012 - 2013 and letting it decline again in

2014. In 2011 the company doesn’t expect any profit at all:

2011 -/- 1% to +1% of revenue

2012 + 7%

2013 + 9%

2014 + 8%

2015 + 7%

|

| Revenue growth and profit prognosis of LinkedIn, estimated by Conor Sen and Ernst Labruyère Printed first in 2011 Click to enlarge |

I think that only a

stock price vs. profit ratio of 15-20 times is healthy and thus a stock price

vs. revenue ratio of 10 is not healthy. If you agree with this concept and with

my forecast of future profits, than a market capitalization of $3.6 bln in 2015

would be more appropriate, instead of $26 bln. If you divide this through 94.5

mln shares (the total amount), the future stockprice in 2015 would be $38.5,

instead of $275.

[...]

LinkedIn itself is

afraid its costs may increase strongly in the coming years and its

profitability may decline. Besides that, LinkedIn might not be as strong in

recruitment (yet) as its most important competition: the real recruiters. And

as the number of profiles in LinkedIn remains increasing, the number of unused,

poorly updated and/or unusable profiles will increase to. This might turn

searching for good candidates via LinkedIn into searching a needle in an

enormous heystack.

And remember: the only

true assets of LinkedIn are those profiles. And please remember too that

Microsoft, Yahoo and Google needed desperately to diversify itself to maintain

their revenue growth and profitability at the current levels. For LinkedIn that

will be quite hard, as their only assets are those profiles. I’m afraid that

LinkedIn might turn into a dog, instead of a cash cow. $45 per share was in my

opinion already very high, but $90-$100 is ridiculous.

Suffice it to say that I have been wrong, very wrong! And the

worst thing is: it is officially on record that I made a fool of myself five

years ago!

No other party than Microsoft is offering $26.2 billion(!) in order to take over

LinkedIn and try to integrate it in its Office Suite, for the benefit of both companies. With that $26.2 billion of Microsoft's money, Conor was right with his estimate and I was wrong.

Here are the pertinent snippets from the

Wall Street Journal:

Microsoft to Acquire

LinkedIn for $26.2 Billion

Deal is for $196 per

LinkedIn share, a 50% premium to Friday’s close

Microsoft has agreed

to buy professional social network LinkedIn for $26.2 billion. The software

giant hopes to jump-start its software packages by connecting them with

LinkedIn's vast network.

Microsoft Corp.

snapped up LinkedIn Corp. for $26.2 billion in the largest acquisition in its

history, betting the professional social network can rev up the tech titan’s

software offerings despite recent struggles by both companies.

The deal is Chief

Executive Satya Nadella’s latest effort to revitalize Microsoft, which was

viewed not long ago as left behind by shifts in technology. Mr. Nadella hopes

the deal will open new horizons for Microsoft’s Office suite as well as

LinkedIn, both of which have saturated their markets, and generally bolster

Microsoft’s revenue and competitive position.

Mr. Nadella said

today’s work is split between tools workers use to get their jobs done, such as

Microsoft’s Office programs, and professional networks that connect workers.

The deal, he said, aims to weave those two pieces together.

As for LinkedIn, the deal offers hope to renew

decelerating growth as well as an exit for shareholders after the stock tumbled

from a peak of $269 in February 2015 to as low as $101.11 last February.

Microsoft will pay

$196 per LinkedIn share, a 50% premium to the social network’s closing price on

Friday.

Of course the fact is now proven beyond a reasonable doubt

that LinkedIn is worth $26.2 billion, otherwise Microsoft would not have paid

that amount for it, wouldn’t it?!

Yet, I have to say that this friendly takeover of LinkedIn

to Microsoft rather resembles a firesale of one desperate company to another

desperate company, than a healthy merger between two strong parties.

The two snippets in red are tell-tale signals by themselves.

Let’s be perfectly clear about

it: snippets like “Both of which have saturated their

markets...”, “offers hope to renew decelerating growth...” are not the

remarks that you want to hear as an investor, after arguably one of the bigger

friendly takeovers in history.

In The Netherlands, this is called a situation

in which “the lame person is helping the

blind one”. That is seemingly an act of despair, not a case of sound judgment.

Roughly two years ago – when LinkedIn was in its heyday – I

already reminded Conor of our little bet, ending in 2016. His brief, but crystalclear

response was then: ‘What are you talking

about, LinkedIn is already much more worth than $25 billion’.

Of course he

was right then: as a trader/ investor he already could have made a bedazzling

profit in 2014 or earlier, on his initial investment from the days of LinkedIn's IPO.

My point in 2011 was, however, that having five years of solid

revenue and profit growth is a helluva promise to fulfil for a quoted company.

Especially when this company has little more on offer than one product (i.e. information

about worker’s resumees and companies

looking for people) and a lot of future growth has already been priced in in

the stock rate.

And while Facebook and Google had ample opportunities to

diversify their business during those years, I happened to see few opportunities for LinkedIn to do the same. I dare to state that I was right then. This becomes very clear when we a. look at LinkedIn’s main

product and b. look at the revenue and profit development for LinkedIn.

LinkedIn still offers the same resumees for companies and

the same information about vacant positions for workers and freelancers. There have been no

mindboggling new inventions and groundbreaking new technologies, emerging from LinkedIn during that period.

It is still quite the same ol’, same ol’ as five years ago... And although LinkedIn has become a

little bit more exiting to use over the years, it is little more than just ‘a

little bit’.

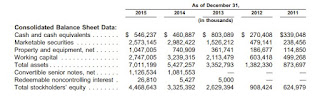

And for the revenue and profit development, let’s look at

the annual data for the last five years:

|

| Profits and Loss statement from 2016 for the period 2011-2015 Data courtesy of LinkedIn Click to enlarge |

|

| Comparison between LinkedIn prognosis by Conor Sen and Ernst in 2011 and the realized revenues and profits of LinkedIn during period 2011-2015 Chart created by: Ernst Labruyère Click to enlarge |

If regarding the revenue growth we compare the real P&L data with the prognosis,

offered by Conor Sen in 2011 (see the first chart in this article), LinkedIn

has done a fantastic job. The company outnumbered the already quite optimistic revenue growth prognosis by an average 15%.

However, when we compare my (already cautious) profit

estimate (see also the first chart in this article) with the actual profit realized by

LinkedIn, the company failed seriously during these last five years in turning its

growing revenues into healthy profits.

Last year the company already presented a small loss of $15

million for the year 2014, but for 2015 the company presented a quite massive loss of $166 million, or

5.5% of its revenues.

And to keep up with the competition, the company needs to

invest much money in new and improved infrastructure and technologies on a nearly daily basis; this is good for high expense levels during 2016 and far beyond.

Then the simple question remains: when

will this company finally fulfil its promise with respect to yielding a flow of healthy profits?! You

perhaps will guess my answer: probably never!

And it seems that the traders and investors have also become aware

of the fact that the star of LinkedIn has started to fade, as you see the plummeting of the stock rate in recent months.

All in all it was a blessing in disguise for the investors

in LinkedIn that Microsoft came along with a big bag full of money last week. And perhaps

Microsoft is indeed able to revive both companies, with the purchase and subsequent incorporation of LinkedIn in its Office suite. However, Microsoft’s track record with

takeovers and mergers (think about Nokia) is not very promising.

Therefore –

and for other reasons - such a successful merger between LinkedIn and the Office Suite would not be my personal investor’s bet when my

own money would be involved, to be honest. Microsoft’s takeover could very well

be its version of the kiss of death for LinkedIn.

But don’t trust me on this...

A few days ago I have been proven very

wrong with my 5 year old bet with Conor Sen, even though I still stand very firmly

behind my reasons for making it in 2011!

No comments:

Post a Comment